Preneed is the term used to describe the prepayment of funeral and/or cemetery services before your death occurs. Prepaying for funeral arrangements might seem like a responsible and practical thing to do for yourself and your family, however it is our opinion that prepaying for funeral services leaves a person susceptible to deceptive sales practices and puts them at risk of becoming victims of fraud. One need only look at the Cemetery and Funeral Bureau’s homepage to understand why we have our doubts. The Bureau’s homepage has this headline as its first link “Cemetery and Funeral Bureau Files Lawsuit Against One of California’s Largest Pre-Need Trusts.” The lawsuit filed by the Bureau against the Funeral Directors Service Corporation, the California Funeral Directors Association, Mechanics Bank, and others alleges that millions of dollars of consumers’ money paid into the “trust” was being misused, misspent, or mismanaged and defendants had improperly invested the trust funds; the trust suffered millions in losses from investments yet the defendants paid themselves despite the losses, in violation of California law. Most recently, the Central Valley Business Times published an article regarding Forethought Group Inc, a company that sells end-of-life policies through funeral planners. Forethought will be returning approximately $25 million to California beneficiaries and has agreed to adopt strict business reforms to ensure prompt payment of benefits in the future as a result of an investigation by Controller John Chiang. Forethought is the fourth insurance company to settle with Mr. Chiang. The Controller reached similar agreements — worth more than an aggregate $135 million for California, alone — with insurer John Hancock in May 2011 and with Prudential Insurance in December 2011 and MetLife in April 2012.

Be aware that corporations expend a great deal of resources to convince consumers that prepaying for a funeral is in their best interest. This is especially true for publicly traded corporations. For example, Services Corporation International (SCI), the largest provider of deathcare services in North America, stated the following in their 2011 Annual Report detailing the importance of preneed sales in the company’s continued growth:

“We believe we are well−positioned for long−term profitable growth. We are the largest company in the North American deathcare industry with unparalleled scale on both a national and local basis and are poised to benefit from the aging of America. ““We continue to build on our extensive consumer research to market our products and services on a preneed basis. Our strategy to combine targeted direct mail, select media advertising, seminars and the internet is generating quality preneed sales leads. During 2011, we continued to focus on enhanced training for sales management and sales counselors and also added additional sales management resources in certain markets aimed at increasing preneed sales production and sales counselor productivity. “

Preplanning for your funeral is always a good idea and most marketing strategies will use the concept of preplanning to get consumers interested in their services with the hope of ultimately convincing them to prepay for their funeral. It is never necessary to involve a funeral home in the preplanning phase. Instead, we recommend you conduct your own research and select funeral services that are right for you and within your budget. Then, communicate these preferences to family or the person(s) that will be responsible for carrying out your wishes after your death. To alleviate others of the financial responsibility for carrying out your plans, set aside some of your savings to cover the cost, and arrange to make that money legally available to the person(s) who will be responsible for carrying out your funeral wishes. This can be done by setting up a Pay on Death (POD) account with your bank or credit union – you name a beneficiary and the money is released to that person on your death without having to go through probate. You will also want to communicate your funeral plans to your family and document them to avoid any confusion. See this article by Nolo titled “Payable-on-Death Accounts: The Basics.”

With all of that said, there is one situation in which it might be a good idea to prepay for your funeral and that is if you’re applying for Medicaid. All states allow you to prepay for a funeral in order to shelter some money for consideration for Medicaid eligibility.

In California, there is no restriction on the amount of money you can set aside for funeral costs provided they are put into an “irrevocable” account or plan. Up to $1500 can be set aside in a “revocable” account or plan (see below for the pros and cons of available options). However, do not purchase an irrevocable plan unless you absolutely need to to qualify for Medicaid now. Funeral costs have been increasing over the years. In the United States alone, the average cost of a funeral has gone up by 32% in just a decade. Many families end up spending more on a funeral than they would have spent on a wedding. So if you haven’t managed to set aside money for your funeral, your relatives can take care of it through loans. For the customers’ convenience, bad credit emergency loans have few requirements, get processed fast, and allow for fast deposits.

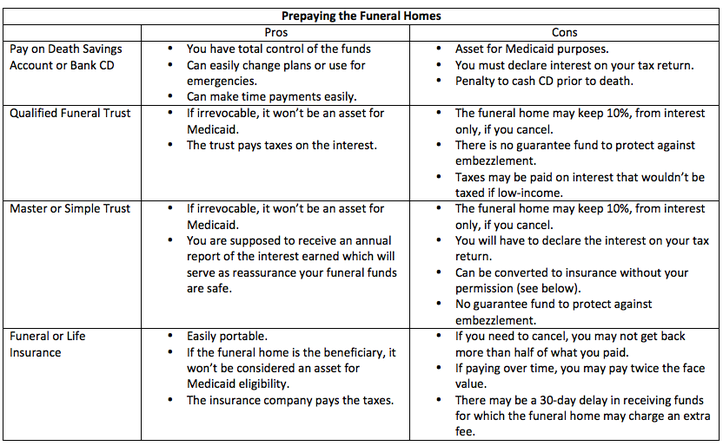

The following table was taken from a pamphlet on California Legal Rights published by the Funeral Ethics Organization

Additional Resources:

US News & World Report: Should You Prepay Your Own Funeral Expenses? Read the full articles…AARP The Magazine: Prepaid Funerals: A Grave Error Read the full article…The Consumerist: Prepaid Funeral Planning: Don’t Do It!